"Essential Guide on How to Pay Back Perkins Loan: Tips and Strategies for Successful Repayment"

### Understanding Perkins LoansThe Perkins Loan is a federal student loan program designed to help students with exceptional financial need. It offers low-i……

### Understanding Perkins Loans

The Perkins Loan is a federal student loan program designed to help students with exceptional financial need. It offers low-interest loans to undergraduate and graduate students, making higher education more accessible. The unique aspect of Perkins Loans is that they are funded by the school, and the repayment terms are generally more favorable compared to other types of loans.

### Importance of Paying Back Perkins Loan

Repaying your Perkins Loan is crucial for maintaining your financial health and credit score. Failure to pay back Perkins Loan can lead to severe consequences, including damage to your credit report, wage garnishment, and loss of eligibility for future federal student aid. Understanding the repayment process and options available to you can ease the burden and help you avoid these pitfalls.

### Steps to Pay Back Perkins Loan

1. **Know Your Loan Details**: Start by gathering information about your Perkins Loan, including the total amount borrowed, interest rate, and repayment terms. This information is typically available through your school’s financial aid office or the loan servicer.

2. **Understand the Grace Period**: After graduation, you typically have a nine-month grace period before repayment begins. Use this time to plan your finances and understand your repayment options.

3. **Choose Your Repayment Plan**: Perkins Loans offer several repayment plans, including standard, graduated, and extended repayment options. Evaluate which plan best fits your financial situation. You may also qualify for deferment or forbearance if you face financial hardship.

4. **Set Up Automatic Payments**: To avoid missing payments, consider setting up automatic withdrawals from your bank account. Many loan servicers offer a discount on your interest rate if you enroll in auto-pay.

5. **Stay in Communication with Your Loan Servicer**: If you encounter difficulties making payments, contact your loan servicer immediately. They can provide options such as deferment, forbearance, or alternative repayment plans.

### Tips for Managing Your Repayment

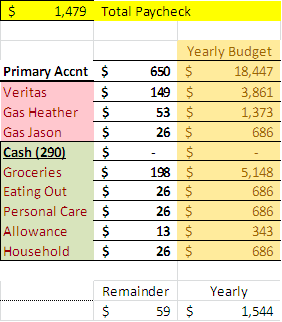

- **Create a Budget**: Establish a monthly budget that includes your loan payments. This will help you manage your finances better and ensure you have enough funds to cover your loan.

- **Make Extra Payments When Possible**: If you have extra funds, consider making additional payments towards your principal balance. This can reduce the overall interest you pay and shorten your repayment period.

- **Track Your Progress**: Regularly check your loan balance and repayment progress. This will motivate you to stay on track and make timely payments.

### Consequences of Defaulting on Perkins Loans

Defaulting on your Perkins Loan can have serious repercussions. Not only will it affect your credit score, but it can also lead to legal action by the loan servicer, including wage garnishment. Furthermore, you will lose eligibility for other federal aid programs, making it even more challenging to finance your education or other needs in the future.

### Conclusion

Paying back your Perkins Loan is an essential step in managing your financial future. By understanding the loan details, choosing the right repayment plan, and maintaining open communication with your loan servicer, you can effectively navigate the repayment process. Remember, staying proactive and informed is key to successfully paying back your Perkins Loan and achieving financial stability.