How Long It Will Take to Pay Off Loan: Unlocking the Secrets to Financial Freedom

Guide or Summary:Understanding Loan Terms and ConditionsCalculating Your Loan Payoff TimelineStrategies to Pay Off Loans FasterThe Benefits of Knowing Your……

Guide or Summary:

- Understanding Loan Terms and Conditions

- Calculating Your Loan Payoff Timeline

- Strategies to Pay Off Loans Faster

- The Benefits of Knowing Your Loan Payoff Timeline

When it comes to managing your finances, understanding how long it will take to pay off a loan is crucial for achieving financial freedom. Whether you're dealing with student loans, personal loans, or a mortgage, knowing the timeline for repayment can help you make informed decisions and set realistic financial goals. In this comprehensive guide, we will explore the factors that influence loan repayment duration, effective strategies to accelerate your repayment, and the benefits of knowing how long it will take to pay off your loan.

Understanding Loan Terms and Conditions

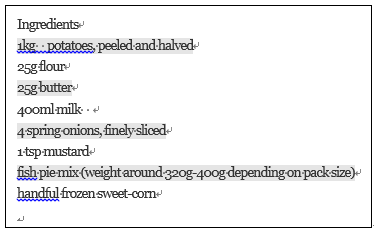

The first step in determining how long it will take to pay off a loan is to understand the terms and conditions associated with it. Loans come with various interest rates, repayment schedules, and fees that can significantly impact the total duration of the loan. For instance, a loan with a lower interest rate may take less time to pay off compared to a higher-rate loan, even if the principal amounts are similar. Additionally, loans with shorter repayment terms typically require higher monthly payments but result in less interest paid over the life of the loan.

Calculating Your Loan Payoff Timeline

To accurately calculate how long it will take to pay off your loan, you can use a loan amortization calculator. By inputting your loan amount, interest rate, and repayment term, you can see a detailed breakdown of your monthly payments and the total time required to pay off the loan. This tool can be invaluable for visualizing your financial future and adjusting your budget accordingly.

Strategies to Pay Off Loans Faster

Once you have a clear understanding of how long it will take to pay off your loan, you may want to explore strategies to expedite the repayment process. Here are some effective methods:

1. **Make Extra Payments**: If your loan allows it, making extra payments can significantly reduce the principal balance, thereby shortening the repayment period. Even small additional payments can lead to substantial savings in interest over time.

2. **Refinance Your Loan**: If you have a good credit score, consider refinancing your loan to secure a lower interest rate. This can reduce your monthly payments and the overall duration of the loan.

3. **Create a Budget**: Developing a strict budget can help you allocate more funds toward loan repayment. Identify non-essential expenses that can be cut back, and redirect those funds to your loan.

4. **Use Windfalls Wisely**: If you receive a bonus, tax refund, or any unexpected financial windfall, consider using a portion of it to make a lump-sum payment on your loan.

The Benefits of Knowing Your Loan Payoff Timeline

Understanding how long it will take to pay off your loan offers several benefits. Firstly, it provides clarity and peace of mind, allowing you to plan your financial future more effectively. Knowing your repayment timeline can also motivate you to stick to your budget and repayment plan, as you can visualize the end goal. Furthermore, achieving your loan payoff milestone can significantly improve your credit score, making it easier to secure favorable terms on future loans.

In conclusion, knowing how long it will take to pay off your loan is not just a matter of interest rates and payment schedules; it's about taking control of your financial destiny. By understanding the factors that influence your loan repayment, employing effective strategies, and staying committed to your financial goals, you can pave the way to a debt-free future. Start your journey today, and unlock the secrets to financial freedom!