Unlock Your Dream Ride: The Ultimate Auto Car Loan Calculator for Smart Financing Decisions

#### Description:Are you ready to drive your dream car but unsure about the financing options available? Look no further! Our comprehensive auto car loan ca……

#### Description:

Are you ready to drive your dream car but unsure about the financing options available? Look no further! Our comprehensive auto car loan calculator is here to simplify your car buying journey. With just a few clicks, you can estimate your monthly payments, total interest, and overall loan cost, empowering you to make informed decisions.

The auto car loan calculator is an essential tool for anyone looking to purchase a vehicle. Whether you’re eyeing a brand-new model or a reliable used car, understanding your financing options is crucial. This calculator allows you to input various parameters such as loan amount, interest rate, and loan term, giving you a clear picture of what to expect financially.

### Why Use an Auto Car Loan Calculator?

1. **Budgeting Made Easy**: The first step in buying a car is knowing how much you can afford. By using the auto car loan calculator, you can determine your budget based on your financial situation. This tool helps you avoid overspending and ensures that you choose a vehicle that fits within your means.

2. **Compare Loan Options**: Different lenders offer various interest rates and terms. With the auto car loan calculator, you can easily compare multiple loan scenarios. By adjusting the interest rate and loan term, you can see how these factors impact your monthly payments and total loan cost. This feature allows you to find the best deal available.

3. **Understand the Impact of Down Payments**: A larger down payment can significantly reduce your monthly payments and the total interest paid over the life of the loan. The auto car loan calculator lets you experiment with different down payment amounts, helping you understand how this affects your financing options.

4. **Plan for Additional Costs**: When budgeting for a car, it’s essential to consider additional costs such as insurance, maintenance, and taxes. The auto car loan calculator can help you factor these expenses into your overall budget, ensuring you’re financially prepared for your new vehicle.

5. **Stay Informed**: The automotive market is constantly changing, with new offers and promotions popping up regularly. By regularly using the auto car loan calculator, you can stay informed about the best financing options available, helping you seize the right opportunity when it arises.

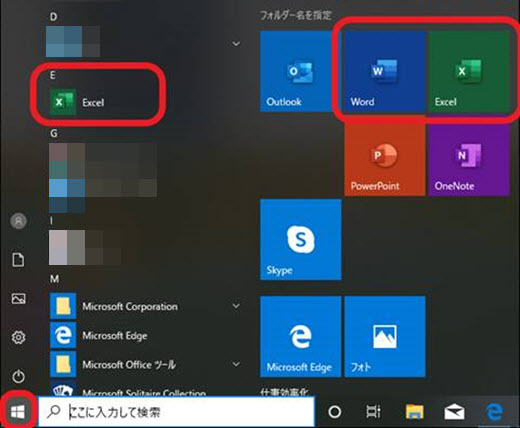

### How to Use the Auto Car Loan Calculator

Using the auto car loan calculator is straightforward:

1. **Enter the Loan Amount**: Input the total amount you plan to borrow for your car purchase.

2. **Choose Your Interest Rate**: This can vary based on your credit score and lender. If you’re unsure, research average rates to get an estimate.

3. **Select the Loan Term**: Decide how long you want to take to repay the loan, typically ranging from 36 to 72 months.

4. **Input Your Down Payment**: If you’re making a down payment, enter that amount to see how it affects your financing.

5. **Calculate**: Click the calculate button to see your estimated monthly payments and total loan cost.

### Conclusion

Purchasing a vehicle is a significant financial commitment, and using an auto car loan calculator is a smart way to navigate this process. By providing you with essential insights into your financing options, this tool empowers you to make informed decisions that align with your budget and financial goals. Don’t leave your car financing to chance—unlock your dream ride today with our user-friendly auto car loan calculator!