How to Secure a 18000 Car Loan with Bad Credit

Guide or Summary:Car LoanUnderstanding Your Credit ScoreImproving Your Credit ScoreChoosing the Right LenderApplying for a 18000 Car LoanCar LoanSecuring a……

Guide or Summary:

- Car Loan

- Understanding Your Credit Score

- Improving Your Credit Score

- Choosing the Right Lender

- Applying for a 18000 Car Loan

Car Loan

Securing a car loan with a credit score of less than 600 can be a daunting task. However, with the right approach, it is entirely possible to get approved for an 18000 car loan despite having bad credit. Here are some strategies and steps to follow to improve your chances of getting approved.

Understanding Your Credit Score

The first step in securing a 18000 car loan with bad credit is to understand your credit score. Your credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850, with higher scores indicating better creditworthiness. A credit score of less than 600 is considered poor, and it can make it challenging to get approved for a car loan.

Improving Your Credit Score

Improving your credit score is essential if you want to get approved for an 18000 car loan with bad credit. Here are some strategies to improve your credit score:

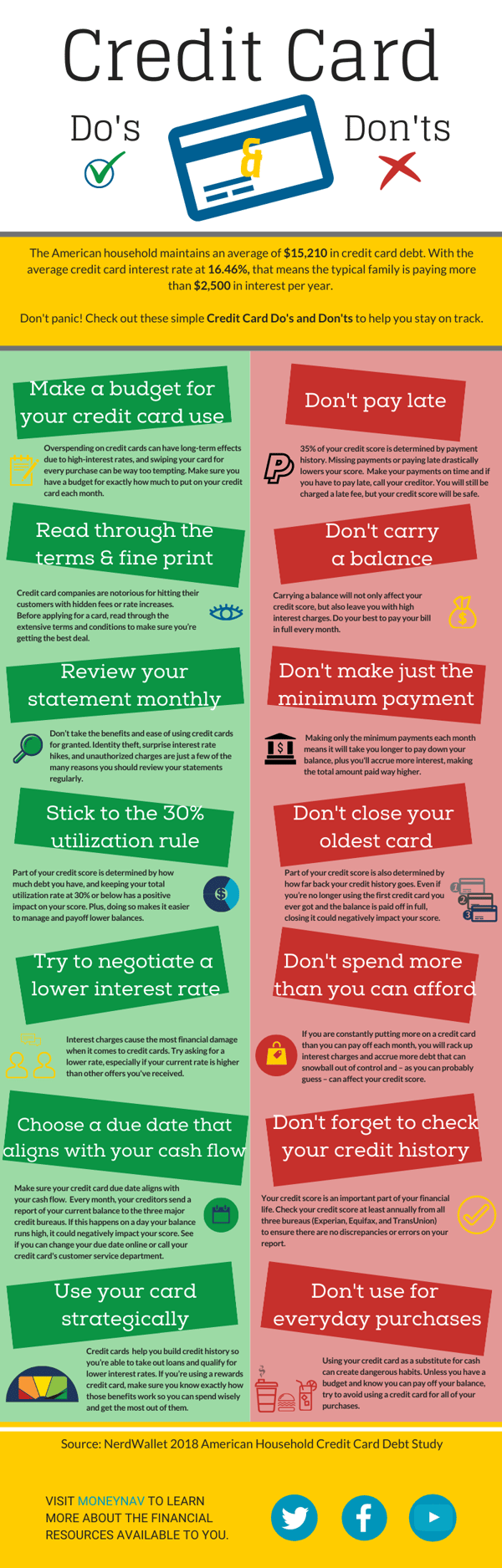

1. Pay your bills on time: Late payments can have a significant negative impact on your credit score. Make sure to pay your bills on time, including credit card payments, utility bills, and loans.

2. Reduce your credit utilization: Credit utilization is the amount of credit you are using compared to your credit limit. Aim to keep your credit utilization below 30%, as high credit utilization can negatively impact your credit score.

3. Check your credit report: Errors on your credit report can negatively impact your credit score. Check your credit report regularly to ensure that all the information is accurate.

Choosing the Right Lender

Choosing the right lender is crucial when you have bad credit. Here are some tips to help you choose the right lender:

1. Research lenders: Research different lenders to find the one that offers the best terms. Look for lenders that offer low interest rates and flexible repayment terms.

2. Check the lender's reputation: Check the lender's reputation by reading reviews and checking their rating on the Better Business Bureau (BBB) website.

3. Compare loan offers: Compare loan offers from different lenders to find the one that offers the best terms.

Applying for a 18000 Car Loan

When applying for a 18000 car loan with bad credit, it is essential to follow these steps:

1. Provide accurate information: Provide accurate information when applying for a car loan. Make sure to provide all the required documents, including proof of income, employment history, and bank statements.

2. Be prepared for rejection: Be prepared for rejection if you have bad credit. If you are rejected, don't get discouraged. Use the experience to improve your credit score and try again later.

3. Consider a co-signer: If you have bad credit, consider getting a co-signer. A co-signer is someone who agrees to pay your loan if you fail to do so.

Securing a 18000 car loan with bad credit is challenging, but it is not impossible. By understanding your credit score, improving your credit score, choosing the right lender, and following the right steps, you can increase your chances of getting approved for a car loan. Remember, improving your credit score takes time, so be patient and persistent. With the right approach, you can achieve your goal of owning a car.