Consolidations Loan: Streamline Your Financial Obligations with Ease

Guide or Summary:Understanding Consolidations LoanThe Benefits of Consolidations LoanChoosing the Right Consolidations LoanIn the ever-evolving financial la……

Guide or Summary:

- Understanding Consolidations Loan

- The Benefits of Consolidations Loan

- Choosing the Right Consolidations Loan

In the ever-evolving financial landscape, managing multiple debts can be a daunting task. Whether you're juggling student loans, credit card balances, or personal loans, the complexity of repayment can lead to stress and financial strain. Enter consolidations loan, a strategic financial solution designed to simplify your debt repayment process. This article delves into the intricacies of consolidations loans, offering insights into how they can streamline your financial obligations and pave the way for a more manageable and less stressful financial future.

Understanding Consolidations Loan

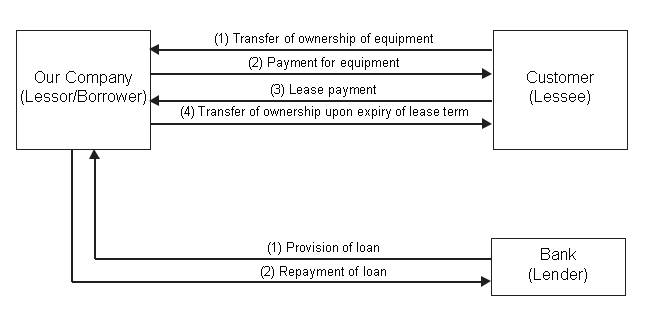

At its core, a consolidations loan is a financial tool that combines existing debts into a single, manageable payment. By doing so, it simplifies the repayment process, often resulting in lower monthly payments and a more predictable repayment schedule. This consolidation can be particularly beneficial for individuals with multiple high-interest debts, as it allows them to secure a single, fixed-rate loan that may offer a lower interest rate than their individual debts.

The Benefits of Consolidations Loan

One of the most compelling advantages of a consolidations loan is the potential for reduced interest rates. When multiple debts are consolidated into one loan, you may qualify for a lower interest rate, which can significantly cut down on the total amount of interest paid over the life of the loan. This reduction in interest payments can result in substantial savings over time, making the consolidation a cost-effective strategy for debt management.

Another significant benefit is the simplification of your financial obligations. By consolidating multiple debts into one payment, you eliminate the need to remember multiple due dates and payment methods. This streamlined approach can reduce the likelihood of missed payments, which can negatively impact your credit score. Furthermore, a consolidations loan often comes with automatic payments, ensuring timely payments and maintaining a positive credit history.

Choosing the Right Consolidations Loan

When considering a consolidations loan, it's crucial to evaluate various factors to ensure it's the right choice for your financial situation. Firstly, compare interest rates and fees associated with different consolidation options. Look for lenders that offer competitive rates and transparent fee structures. Additionally, consider the repayment terms, including the duration of the loan and the flexibility of the repayment schedule. A consolidations loan with a longer repayment term may result in lower monthly payments, but it may also extend the time it takes to become debt-free.

In conclusion, consolidations loan stands as a beacon of hope for individuals grappling with multiple debts. By merging existing obligations into a single, manageable payment, it offers a pathway to financial freedom and peace of mind. With its potential for reduced interest rates and simplified repayment processes, a consolidations loan can be a transformative tool in your financial journey. However, it's essential to conduct thorough research and choose a consolidations loan that aligns with your financial goals and circumstances. By doing so, you can navigate the complexities of debt repayment with confidence and ease.