Understanding Home Equity Loan vs Mortgage: Which is Right for You?

#### Home Equity Loan vs MortgageWhen it comes to financing your home or accessing its value, two popular options often come to mind: home equity loan and m……

#### Home Equity Loan vs Mortgage

When it comes to financing your home or accessing its value, two popular options often come to mind: home equity loan and mortgage. Both financial products can serve your needs, but they operate in different ways and come with distinct advantages and disadvantages. This article will delve into the differences between these two options, helping you make an informed decision based on your financial situation.

#### What is a Home Equity Loan?

A home equity loan allows homeowners to borrow against the equity they have built up in their property. Equity is the difference between the current market value of the home and the amount owed on any existing mortgage. Home equity loans typically come with a fixed interest rate and a lump sum payment, which means you receive a one-time payment that you will repay over a set term, usually 5 to 15 years.

One of the primary advantages of a home equity loan is that it can provide significant funds for large expenses, such as home renovations, medical bills, or education costs. Additionally, the interest paid on home equity loans may be tax-deductible, making them an attractive option for many homeowners.

However, there are risks associated with home equity loans. Since your home serves as collateral, failing to repay the loan can result in foreclosure. Additionally, if property values decline, you may find yourself owing more than your home is worth, a situation known as being "underwater."

#### What is a Mortgage?

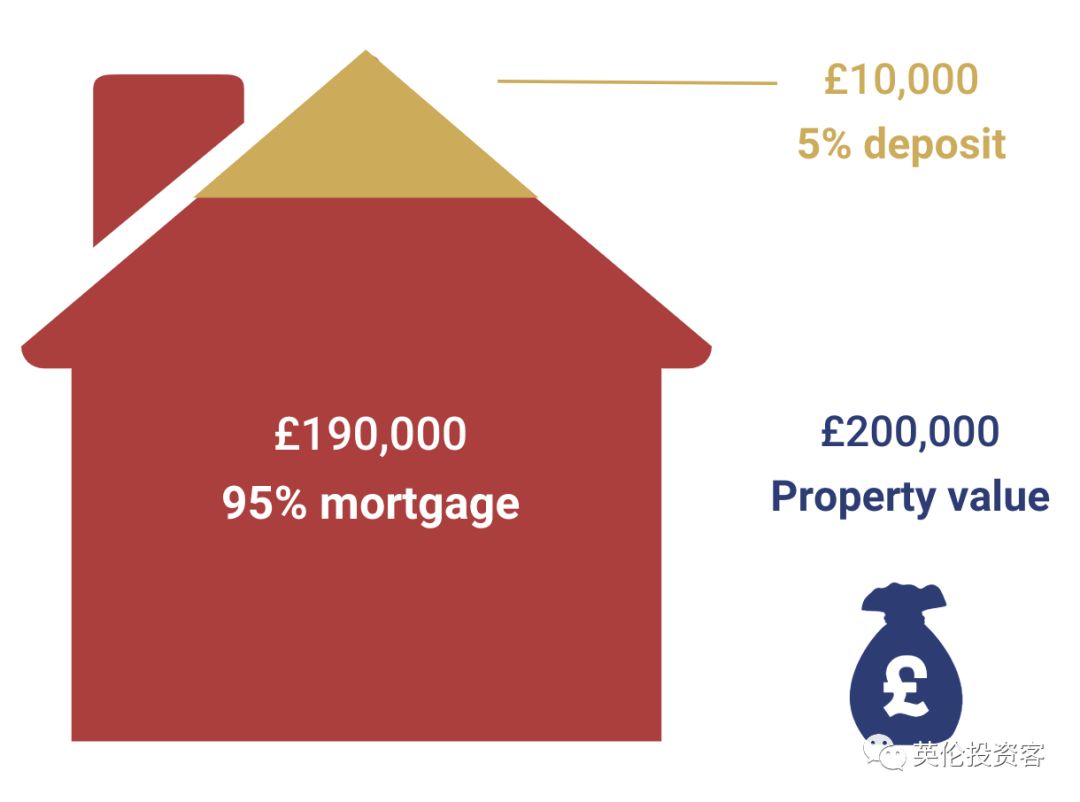

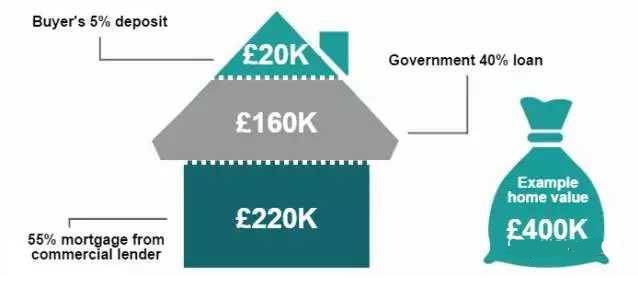

A mortgage is a loan specifically used to purchase a home. When you take out a mortgage, you're borrowing money from a lender to buy a property, and you agree to pay back that money, plus interest, over a specified period, typically 15 to 30 years. Mortgages can be fixed-rate or adjustable-rate, depending on the terms of the loan.

The main advantage of a mortgage is that it allows you to buy a home without having to pay the full purchase price upfront. This makes homeownership accessible to many people who might not have enough savings to buy a home outright. Like home equity loans, the interest on mortgages can also be tax-deductible, providing additional financial benefits.

However, mortgages come with their own set of challenges. They often require a down payment, which can be a barrier for some buyers. Additionally, the process of securing a mortgage can be lengthy and complex, often involving credit checks, appraisals, and various fees.

#### Home Equity Loan vs Mortgage: Key Differences

When comparing home equity loans and mortgages, several key differences emerge:

1. **Purpose**: A mortgage is primarily used to purchase a home, while a home equity loan is used to access the equity in an already owned home.

2. **Loan Amount**: Mortgages typically involve larger sums of money since they are used to buy property, whereas home equity loans depend on the amount of equity you have built up.

3. **Repayment Terms**: Home equity loans usually have shorter repayment terms compared to mortgages, which can extend over several decades.

4. **Interest Rates**: Home equity loans often come with fixed interest rates, while mortgages can have either fixed or adjustable rates.

#### Conclusion

Choosing between a home equity loan and a mortgage depends on your specific financial needs and circumstances. If you're looking to purchase a new home, a mortgage is the way to go. However, if you want to leverage the equity in your existing home for expenses, a home equity loan may be the better choice. Always consider consulting with a financial advisor to explore your options and find the best solution for your financial goals.