Unlocking Financial Opportunities: How Can You Get a Bank Loan in 2023?

Guide or Summary:Personal LoansMortgage LoansAuto LoansBusiness Loans Assess Your Financial Situation Check Your Credit Score Research Lenders Gather Requir……

Guide or Summary:

- Personal Loans

- Mortgage Loans

- Auto Loans

- Business Loans

- Assess Your Financial Situation

- Check Your Credit Score

- Research Lenders

- Gather Required Documentation

- Apply for the Loan

- Wait for Approval

- Review the Loan Agreement

- Receive Your Funds

#### How Can You Get a Bank Loan?

Getting a bank loan can be a crucial step in achieving your financial goals, whether you are looking to buy a home, start a business, or fund an education. However, the process can seem daunting if you're unfamiliar with the requirements and steps involved. In this guide, we will explore how you can get a bank loan, breaking down the process into manageable parts to help you navigate your way to financial success.

#### Understanding the Types of Bank Loans

Before you delve into the application process, it's essential to understand the different types of bank loans available. Common types include:

Personal Loans

These are unsecured loans that can be used for various personal expenses, such as medical bills, vacations, or debt consolidation. Lenders typically assess your creditworthiness to determine eligibility.

Mortgage Loans

If you're looking to purchase a home, a mortgage loan is what you need. These loans are secured by the property itself, meaning the bank can take possession if you fail to repay.

Auto Loans

For those interested in purchasing a vehicle, auto loans are specifically designed for this purpose. Similar to mortgages, these loans are secured by the vehicle.

Business Loans

If you're an entrepreneur or small business owner, a business loan can help you fund startup costs, expand operations, or manage cash flow.

#### Steps to Get a Bank Loan

Now that you understand the types of loans, let’s look at the steps involved in securing a bank loan.

1. Assess Your Financial Situation

Before applying for a loan, take a close look at your finances. Determine how much you need to borrow and assess your ability to repay it. This includes reviewing your income, expenses, and existing debts.

2. Check Your Credit Score

Your credit score plays a significant role in your ability to secure a loan and the interest rates you will be offered. Obtain a copy of your credit report and check for any discrepancies. Aim for a score above 700 for better loan terms.

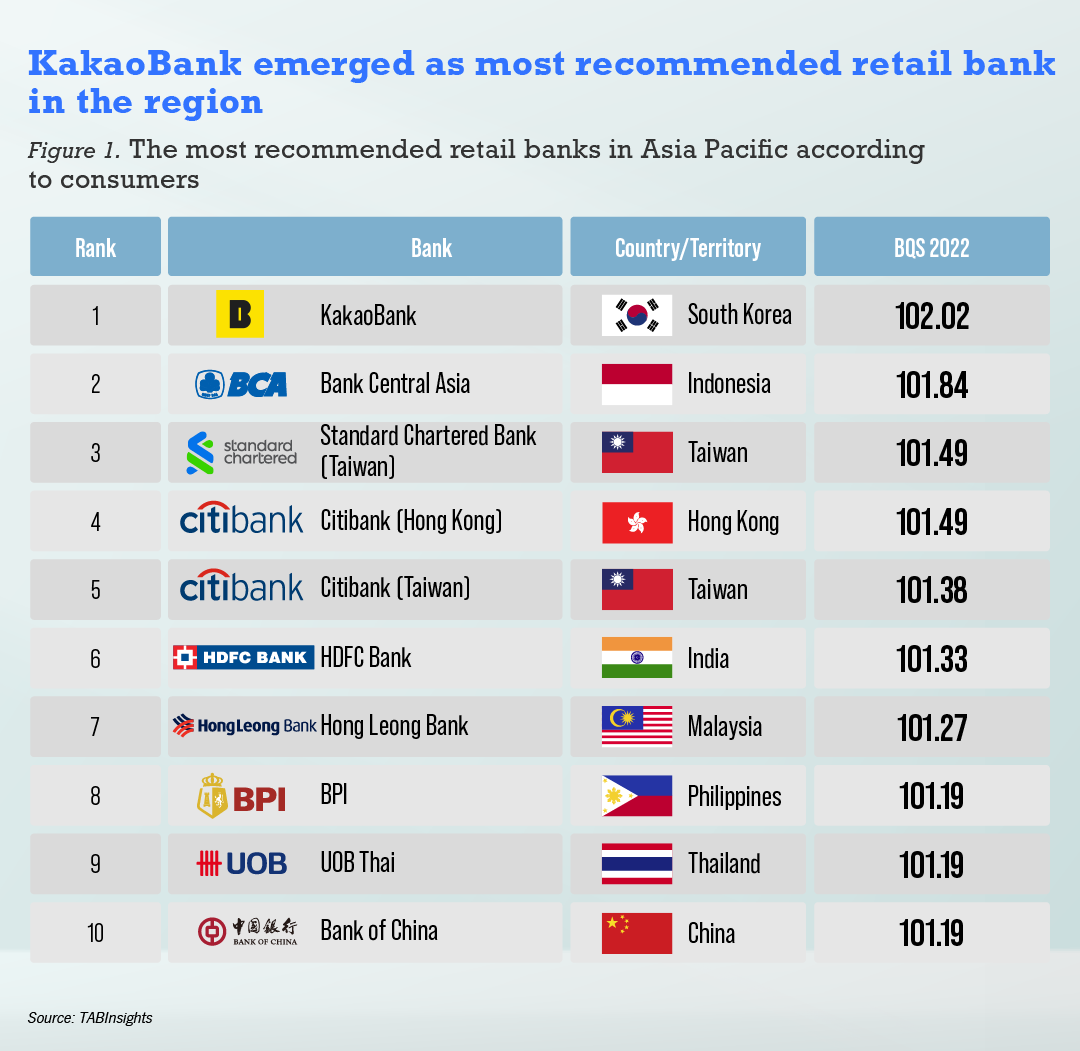

3. Research Lenders

Not all banks offer the same loan products or terms. Shop around and compare interest rates, fees, and repayment terms from various lenders. Consider both traditional banks and online lenders to find the best deal.

4. Gather Required Documentation

When applying for a loan, you will need to provide various documents, including proof of income (pay stubs, tax returns), identification, and details about your debts and assets. Having these documents ready can expedite the process.

5. Apply for the Loan

Once you’ve chosen a lender and gathered your documentation, it’s time to apply. This can often be done online, over the phone, or in-person. Be prepared to answer questions about your financial situation and the purpose of the loan.

6. Wait for Approval

After submitting your application, the lender will review your information and make a decision. This process can take anywhere from a few hours to several days, depending on the lender’s policies.

7. Review the Loan Agreement

If approved, carefully review the loan agreement. Pay attention to the interest rate, repayment terms, and any fees associated with the loan. Make sure you understand all the terms before signing.

8. Receive Your Funds

Once you have signed the agreement, the lender will disburse the funds. Depending on the type of loan, this could be done via a direct deposit into your bank account or a check.

#### Conclusion

In conclusion, understanding how you can get a bank loan is essential for managing your financial future. By assessing your financial situation, checking your credit score, researching lenders, and carefully following the application process, you can increase your chances of securing the funding you need. Remember, a loan is a financial commitment, so it’s important to borrow responsibly and ensure you can meet the repayment terms. With the right preparation and knowledge, you can unlock the financial opportunities that a bank loan can provide.