Understanding the FHA Loan Process: How Long Does FHA Loan Take to Close?

#### How Long Does FHA Loan Take to Close?The FHA loan process is a popular option for many homebuyers, especially first-time buyers, due to its lower down……

#### How Long Does FHA Loan Take to Close?

The FHA loan process is a popular option for many homebuyers, especially first-time buyers, due to its lower down payment requirements and more flexible credit score criteria. However, one of the most common questions that prospective borrowers ask is, "How long does FHA loan take to close?" Understanding the timeline for closing an FHA loan can help you plan better and set realistic expectations for your home-buying journey.

#### The FHA Loan Timeline

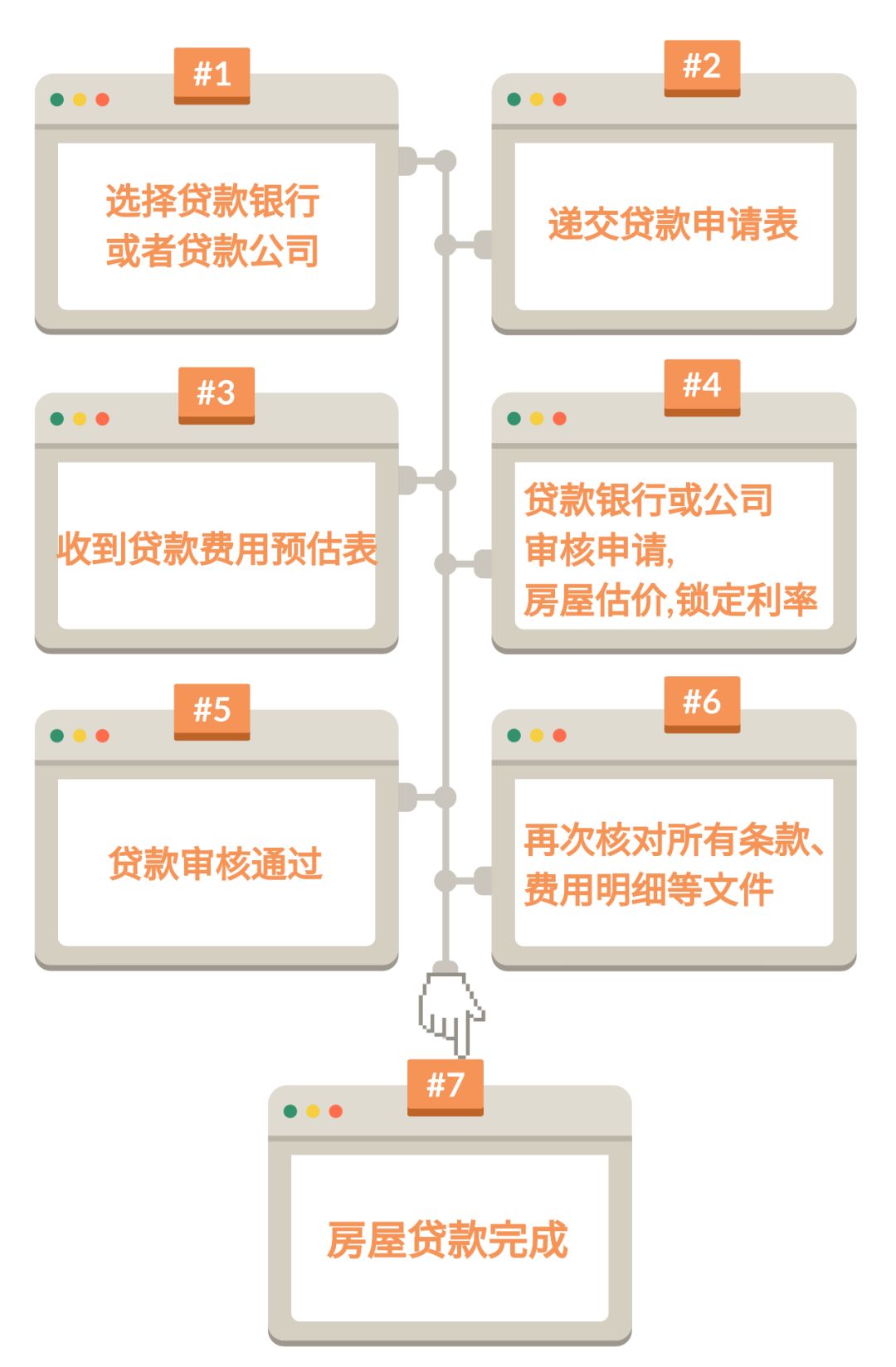

The FHA loan process typically takes longer than conventional loans, primarily due to the additional paperwork and requirements involved. On average, closing an FHA loan can take anywhere from 30 to 60 days, though several factors can influence this timeline.

1. **Pre-Approval Stage**: The first step in the FHA loan process is obtaining pre-approval from a lender. This stage usually takes a few days to a week, depending on how quickly you can provide the necessary documentation, such as income verification, credit history, and employment details.

2. **Home Search and Offer**: Once you are pre-approved, you can begin searching for a home. The duration of this stage varies widely based on the housing market, your preferences, and how quickly you find a suitable property.

3. **Loan Application**: After finding a home and having your offer accepted, you will submit a formal loan application. This process can take a few days, as you will need to gather and submit additional documentation required by the lender.

4. **Processing and Underwriting**: Once your application is submitted, the lender will begin processing your loan. This is where they verify your information and assess your eligibility for the FHA loan. The underwriting process can take anywhere from a week to several weeks, depending on the lender's workload and the complexity of your financial situation.

5. **Closing**: After underwriting is complete and your loan is approved, you will move on to the closing stage. This typically involves signing various documents and finalizing the details of your loan. Closing can take a few hours, but scheduling the closing date may take additional time, especially if there are any last-minute issues that need to be resolved.

#### Factors Influencing the Timeline

Several factors can affect how long it takes to close an FHA loan:

- **Lender Efficiency**: Different lenders have varying processing times. Some may expedite the process, while others may take longer due to internal policies or staffing levels.

- **Market Conditions**: In a competitive housing market, you may face delays if multiple offers are being considered or if the seller is not in a hurry to close.

- **Documentation Completeness**: If your documentation is incomplete or if there are discrepancies in your financial information, this can lead to delays in processing your loan.

- **Appraisal and Inspection**: FHA loans require property appraisals and inspections to ensure that the home meets certain safety and livability standards. Delays in scheduling these assessments can extend the closing timeline.

#### Conclusion

In summary, when considering how long does FHA loan take to close, it’s essential to factor in the various stages of the loan process and the potential influences on the timeline. While the average closing time is between 30 to 60 days, being prepared and organized can help streamline the process. Make sure to communicate regularly with your lender and real estate agent to stay updated on your loan status and any potential delays. Understanding the FHA loan process can empower you to navigate your home-buying journey with confidence.