What Happens If I Don’t Pay My Student Loans? Understanding the Consequences and Options

Guide or Summary:Consequences of Defaulting on Student LoansImpact on Your Credit ScoreCollection Actions and Legal ConsequencesLoss of Eligibility for Fede……

Guide or Summary:

- Consequences of Defaulting on Student Loans

- Impact on Your Credit Score

- Collection Actions and Legal Consequences

- Loss of Eligibility for Federal Benefits

- Options for Managing Student Loan Debt

- The Importance of Communication with Your Lender

- Seeking Financial Counseling

- Conclusion: Take Action Before It’s Too Late

**Translation of "What happens if I don’t pay my student loans":** What happens if I don’t pay my student loans

---

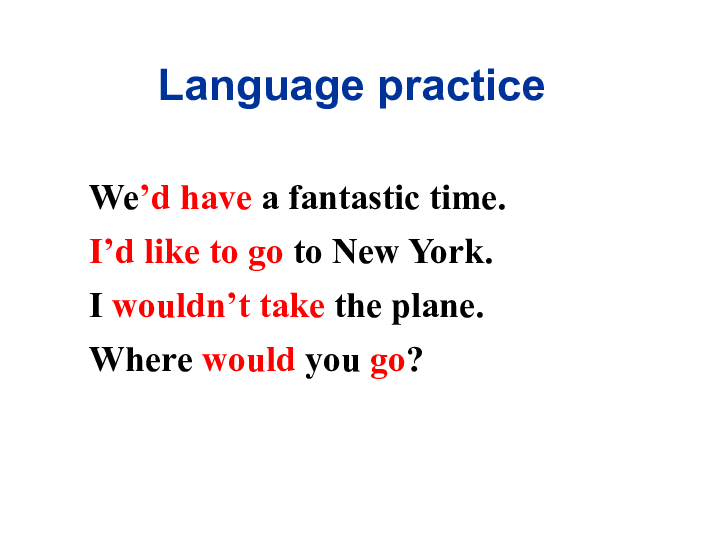

Consequences of Defaulting on Student Loans

Failing to pay your student loans can lead to serious financial repercussions. When you miss payments, your loan account may be considered "delinquent," which can result in late fees and damage to your credit score. If the delinquency continues, typically for 90 days or more, your loan may go into default. Defaulting on your student loans can have long-lasting consequences that affect your financial future.

Impact on Your Credit Score

One of the most immediate effects of not paying your student loans is the impact on your credit score. Your payment history is a significant factor in determining your credit score, and missed payments can lower your score by a substantial amount. A lower credit score can make it difficult to secure other forms of credit, such as mortgages or car loans, and can also lead to higher interest rates when you do qualify for credit.

Collection Actions and Legal Consequences

If you default on your loans, your lender may take collection actions against you. This can include sending your debt to a collection agency, which can further damage your credit score and lead to aggressive collection tactics. In some cases, lenders may even pursue legal action to recover the owed amount, which can result in wage garnishment or bank account levies.

Loss of Eligibility for Federal Benefits

Defaulting on your federal student loans can result in the loss of eligibility for various federal benefits. This includes the inability to access federal financial aid for future education, as well as the potential loss of tax refunds through the Treasury Offset Program. This program allows the government to withhold tax refunds to recover defaulted student loans.

Options for Managing Student Loan Debt

If you find yourself in a situation where you cannot pay your student loans, it is essential to explore your options. Many federal loans offer deferment or forbearance, which allows you to temporarily pause your payments without going into default. Additionally, income-driven repayment plans can help make your monthly payments more manageable based on your income level.

The Importance of Communication with Your Lender

If you're struggling to make your payments, it's crucial to communicate with your lender. Most lenders are willing to work with borrowers who are proactive about their situation. They may offer alternatives such as restructuring your loan or providing temporary relief options.

Seeking Financial Counseling

For those overwhelmed by student loan debt, seeking help from a financial counselor can be beneficial. These professionals can provide guidance on budgeting, debt management, and exploring options tailored to your specific financial situation.

Conclusion: Take Action Before It’s Too Late

Understanding what happens if you don’t pay your student loans is vital for maintaining your financial health. The consequences can be severe, but there are options available to help you manage your debt. Taking action early, communicating with your lender, and seeking professional help can make a significant difference in your financial future. Remember, ignoring the problem will only make it worse, so it’s essential to address your student loan situation as soon as possible.