Understanding Mortgage Insurance Requirements for Conventional Loans: What You Need to Know

Guide or Summary:Introduction to Mortgage InsuranceWhat is Mortgage Insurance?Types of Mortgage InsuranceMortgage Insurance Requirements for Conventional Lo……

Guide or Summary:

- Introduction to Mortgage Insurance

- What is Mortgage Insurance?

- Types of Mortgage Insurance

- Mortgage Insurance Requirements for Conventional Loans

- Cost of Mortgage Insurance

- How to Cancel Mortgage Insurance

#### Translation of "mortgage insurance requirements for conventional loans":

- Mortgage Insurance Requirements for Conventional Loans

---

Introduction to Mortgage Insurance

When it comes to buying a home, understanding the financial obligations involved is crucial. One important aspect of financing a home is mortgage insurance. This insurance is particularly relevant for those considering conventional loans. In this article, we will delve into the mortgage insurance requirements for conventional loans, helping you navigate the complexities of home financing.

What is Mortgage Insurance?

Mortgage insurance is a policy that protects lenders in case a borrower defaults on their loan. It is typically required for borrowers who make a down payment of less than 20% of the home’s purchase price. The insurance ensures that the lender can recover some of the losses if the borrower fails to repay the loan.

Types of Mortgage Insurance

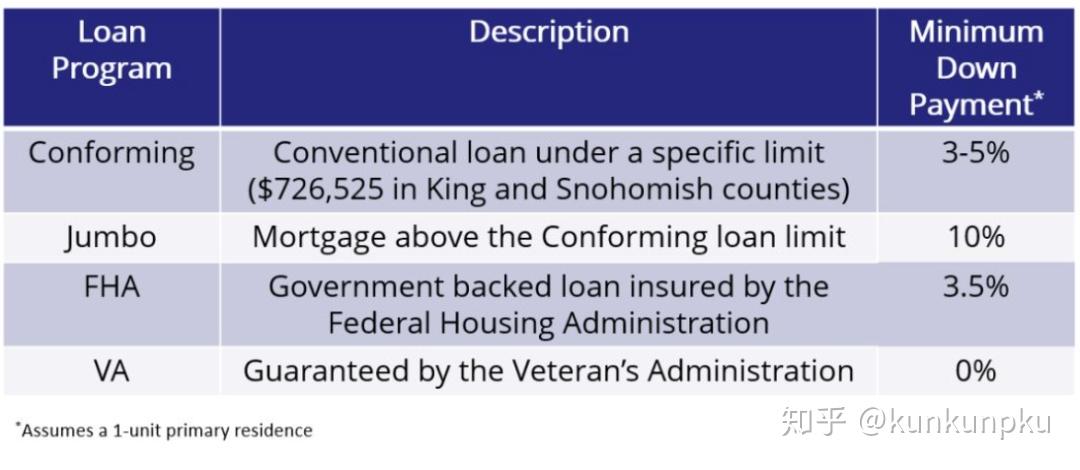

There are two main types of mortgage insurance associated with conventional loans: Private Mortgage Insurance (PMI) and Mortgage Insurance Premium (MIP). PMI is the most common form of mortgage insurance for conventional loans. MIP is typically associated with FHA loans. For our discussion, we will focus on PMI, as it directly relates to mortgage insurance requirements for conventional loans.

Mortgage Insurance Requirements for Conventional Loans

To qualify for conventional loans with PMI, borrowers must meet certain requirements. Here are the key factors to consider:

1. **Down Payment**: The most significant factor influencing the need for mortgage insurance is the down payment. If you put down less than 20%, PMI will likely be required. The percentage of the down payment will also affect the cost of PMI.

2. **Credit Score**: Lenders will evaluate your credit score when determining your eligibility for a conventional loan and the associated mortgage insurance. A higher credit score can lead to lower PMI rates, while a lower score may result in higher premiums.

3. **Loan-to-Value Ratio (LTV)**: The LTV ratio is calculated by dividing the loan amount by the appraised value of the property. A higher LTV ratio (above 80%) typically requires PMI. Lenders use this ratio to assess the risk of lending to you.

4. **Loan Type**: Different types of conventional loans may have varying PMI requirements. For instance, a fixed-rate mortgage might have different insurance needs compared to an adjustable-rate mortgage.

5. **Term of the Loan**: The length of the loan can also impact mortgage insurance requirements. Some lenders may have specific guidelines based on whether you are taking out a 15-year or 30-year loan.

Cost of Mortgage Insurance

The cost of PMI can vary significantly based on the factors mentioned above. Typically, PMI costs range from 0.3% to 1.5% of the original loan amount annually. This premium can be paid monthly, upfront, or a combination of both. Understanding how these costs fit into your overall budget is essential when considering a conventional loan.

How to Cancel Mortgage Insurance

One of the benefits of PMI is that it can be canceled once you reach a certain equity threshold in your home. According to the Homeowners Protection Act, you can request cancellation of PMI when your loan balance reaches 80% of the original value of the home. Additionally, lenders are required to automatically terminate PMI when the loan balance reaches 78% of the home’s original value.

Navigating the mortgage insurance requirements for conventional loans can be complex, but understanding the key components—such as down payment, credit score, and loan-to-value ratio—can help you make informed decisions. By being aware of these requirements and costs, you can better prepare for homeownership and potentially save money in the long run. Always consult with a mortgage professional to get personalized advice tailored to your financial situation.